If a strategy meets a goal: its working. If a strategy meets a target: It’s a success. — Michael Porter

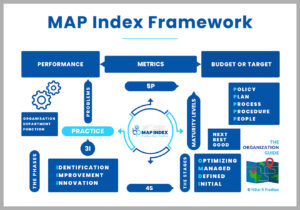

Performance is the key to business organization management. Business is all about performance. We can have different dimensions to measure performance but we cannot have business without performance. Then it raises many questions. How to define it? How to measure it? How to monitor it? How to set it right? How to get it going? Every organization wants to grow and keep performing at its best. There are different ways to look at the parameters of performance.

Since business organizations are so much about profit, finance becomes one of the most important parameter for performance measure. The profit is linked to the business turnover and the cost of operation. Organization looks at how the business is growing. Organization looks at how the cost is managed. If we are growing rapidly but we are having no control on the aspects of cost then profit will be affected. If we are growing moderately but having a good control on the costs profit will be managed.

The moot question then comes about profit – what profit is the best? After all business organizations are working for the motive of profit. Hence, maximizing profit remains the major motto of company and the more is the profit the merrier it is. Unfortunately, profit is dependent on business growth and business expenditure. Both are inter-dependent on the amount of resources available. In organizations resources are limited in nature. How to prioritize things in organization and use the available resource in the best possible manner?

There is an art and science to resource planning and utilization. Those organizations which plan it well and deploy those limited resources efficiently have a better performance of their profit. We have the balance sheet and profit and loss account to give a detailed account of the financial performance. There are asset and liabilities captured in the balance sheet which needs to be balanced. There are incomes and expenditures captured in the P&L account and the financial statement states whether the company is making profit or in loss. All this balancing act and stating the account is a factor of how we are managing our resources both our financial and other resources.

Finance is one part of the resource which is needed to get other forms of resources and get the best possible results from various other resources. People are the most important resources after the financial resources. No organization can function without people resources effectively deployed and managed. The financial resources are the science part and the people resource is the art part of resource management. We have financial budgeting system to set the financial planning and utilization of funds in some perspective. We have organization structuring as a system to get the people positioned properly and deployed in an effective manner. The way the people’s roles are defined and the authorities that are given to them. People cannot perform without role clarity and financial authorities. They may have all the abilities but in organization they have to work in certain culture and business conditions.

There are two ways to look at the resource deployment strategy; after all it is linked to the overall business planning and strategy of the company. There are short-term and long-term business goals for the company. Resources have to be planned accordingly to keep these goals in right perspective. The organization cannot deploy all it resources immediately to maximize its short-term goals. It has to plan for the long-term goals which need appropriate resource allocation.

Striking a balance is an art and business leader develop with time tested working and with constant refinement of their vision. Also, there are fast changing business environment which changes the dynamics of short-term goals and needs to be addressed. Resources need to be dynamically shifted and reallocated as market demand changes. Market drives the business and the organization has to be responsive to such dynamic changes. Being vigilant and being agile to such changes is the smart and the right way to respond and stay ahead of the curve.

Hence, it is not an easy task to manage and balance between the short and long-term goals of the company. Two things are pretty clear that organizations have to grow business and organizations have to simultaneously control cost. Growth is about setting business targets and achieving it in given time. The targets could be sales turnover to product quantity or volume sales to number of customers to number of regions to share of domestic sales to export sales to sales from new product development to production quantity to capacity utilization.

At the same time these targets cannot have a free flow of resources to achieve such numbers. There has to be set anchor. There has to be limit of resources to every such number. The control of such resources is stated in budgets. There are budget caps to the marketing spend a company can make and is subjected to achieving certain sales turnover. It is stated in percentage terms to sales turnover. There are caps to the human resource spend a company can have and it is subjected to the sales turnover. It is also stated in percentage to the sales turnover. There are budget to the production cost which is subjected to a certain level of production to be met. As we can clearly see there are two distinct dimensions to the measurement of performance of a business organization.

It is about setting the budget and getting the target achieved.

If the organization is able to meet its budget and get its target, then the business is on good course and needs to be coasted well. The key question is how to set the budget and get the target. The budget is set on what target the business wants to achieve. The budget is set on what it has actually done in the past. The past performance is taken into account and juxtaposition with the financial forecasting that is made for the forthcoming year. The past data are there as clear evidence of how exactly the organization has performed and under what circumstances it can be assessed.

However, when it comes to the future projection lots of assumptions have to be made and the sales plan is intrinsically contingent to so many factors and variables. We cannot go overboard on our future planning if we have performed well in the previous year where the conditions were favorable whereas the future seems grim. We need to be more prudent in our planning and calculative in our measures. In favorable conditions the sales targets have to be stretched and tested. In unfavorable conditions the cost needs to be cut and controlled.

Now, we know where to set the budget and where to set the target.

These things are dynamic in nature and needs to be moderated and accelerated depending on the business conditions and market scenarios. Organization does business scenario planning and it makes plan for different such scenarios ranging from the best case to the worst case scenario. It is well known statement in the business circle that if we don’t plan we are actually planning to fail. Hence, planning is a must for business success. However just good planning will not guarantee success. The meticulous planning needs to be scrupulously followed with clinical execution. The execution remains the biggest challenge for any organization.

People resources are at the helm of such execution affair. The organization can have full resources allocated and the perfect plan in place but it makes no sense if it is not executed as planned or programmed to be done to get the best results. It boils down to the practice of planning. The business plan without a set target and a set budget will lose direction and control. No organization wants to lose their direction and control of the business they are doing. Hence, they have to set the target and put the budget in place.